Renowned ethnic snack manufacturer Bikaji Foods International has strategically identified six ‘focus’ states, with aspirations for remarkable 1.5X growth in these markets. This ambitious endeavour comes in contrast to the company’s three core states, which presently contribute to over 70% of its total revenues, as disclosed by top officials.

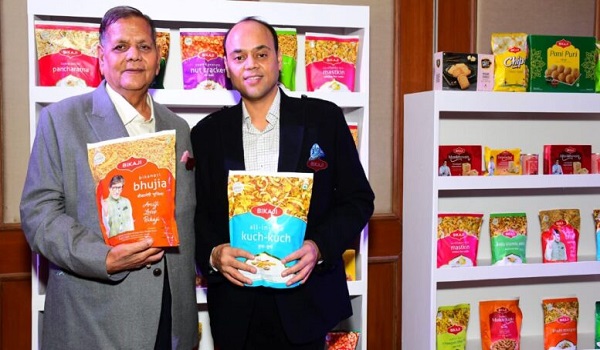

Manoj Verma and Rishabh Jain provided insights into various aspects, including the company’s quarterly performance, inflation impact, expansion initiatives, and the rationale behind their recent acquisition.

Manoj Verma highlighted the significance of sweets and gifting during Q2 and Q3, emphasizing the delayed impact of Diwali on the company’s numbers. Despite a 17.5% delivery in the snacks business, there was a dip in the sweet’s category due to a shift in the quarter.

Rishabh Jain emphasized volume growth and gross margin as critical factors. Notably, the company has expanded its direct coverage to 46,000 outlets, opened four new depots in strategic locations, and is set to commission a frozen plant next month. Jain highlighted the impressive increase in gross margin from 24% at the time of the IPO to 33% in the last quarter. The company achieved significant milestones, surpassing Rs 11,000 crore in sales in the first six months, with a notable 17% volume growth in the snack category.

Rishabh Jain discussed the impact of inflation on prices, stating that after a period of increase until Q3 of the previous year, there was a subsequent decrease. Bikaji Foods responded by passing on the benefits to consumers, leading to 17% volume growth in the snack category.

Manoj Verma acknowledged the pressure in rural markets due to extended monsoons but noted a positive recovery post-Raksha Bandhan, driven by festive sentiments.

Bikaji Foods strategically divides its focus between core states (North, Rajasthan, Assam, and Bihar) and six identified focus states (North: Haryana, Punjab, Delhi, UP; South: Karnataka, Telangana). The company expects the focus states to grow 1.5 times faster than the core states.

Manoj Verma described the recent acquisition as a strategic move aligned with the company’s philosophy of not positioning Bikaji as a discounting brand. The acquisition of Bhujialalji serves as a complementary brand, enabling Bikaji to navigate e-commerce platforms and new geographies without diluting Bikaji’s equity in its strong states. The company remains open to more such strategic deals in the future.