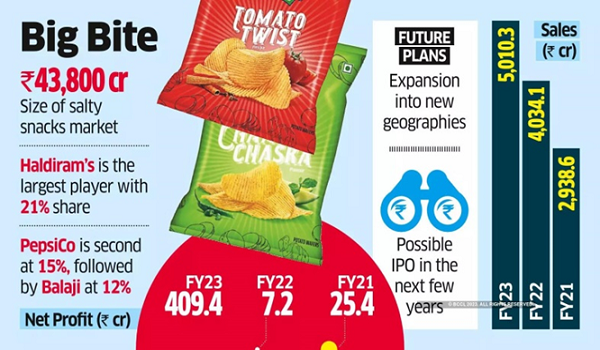

Balaji Wafers, a regional snacking sensation that garnered acquisition interest from multinational giants like PepsiCo, has reported a remarkable achievement by crossing the INR 5,000-crore annual sales mark in the fiscal year ending March 2023. This impressive figure reflects a substantial 24% increase compared to the previous fiscal year, when the company’s sales stood at INR 4,034 crore.

Despite primarily operating in less than a dozen states, predominantly in the western regions of Gujarat, Maharashtra, and Rajasthan, Balaji Wafers has secured a substantial 65% share in the organized market for its products, which include potato chips, bhujia, and namkeens.

In a notable financial performance, the company’s net profit surged to INR 409 crore in FY23, a significant leap from the previous year’s INR 7.2 crore. The robust financial results come after facing challenges in the preceding years, marked by unprecedented increases in edible oil, logistics, and packaging costs that impacted margins.

Chandubhai Virani, co-founder of Balaji Wafers, explained, “Our profits were impacted during the pandemic due to rising costs, but in FY23, with reduced input costs and stabilized prices, we have returned to normal profitability.” He highlighted the company’s resilience during challenging times, including the loss of senior employees to competition in FY22, leading to a reduction in staff costs.

Balaji Wafers, originally established in 1982 as a supplier of snacks to a movie theatre, has witnessed a remarkable surge in sales, more than doubling since the onset of the pandemic. As of now, the company holds the third-largest share (12%) in India’s salty snacks market, following Haldiram’s (21%) and PepsiCo (15%). Remarkably, as a single brand, Balaji now surpasses any individual brand under PepsiCo in the same market, including Lay’s and Kurkure.

The company’s success is attributed to its unique business model, offering products at prices 20–30% lower than national brands while ensuring steady volumes through economies of scale. Balaji Wafers distinguishes itself by controlling most operations, with a large portion of manufacturing done in-house across its four factories, accompanied by minimal advertising and promotion efforts.

Balaji Wafers’ approach, focusing on affordability and value for money, has positioned it as a formidable player in the snacking industry. Industry experts acknowledge the company’s low pricing strategy as a significant factor, emphasizing the importance of affordability in the snacking segment. Krishnarao Buddha, Senior Category Head, Marketing at Parle Products, noted, “The biggest USP of Balaji has been low pricing, and in snacking, affordability is the biggest factor for consumers who seek value for money.”