Hindustan Unilever (HUL) is set to introduce Liquid IV, Unilever’s globally successful hydration drink, to India’s premium market segment. The move is part of HUL’s strategy to enhance its premium product offerings in the beauty and wellbeing sector, catering to affluent consumers with active lifestyles.

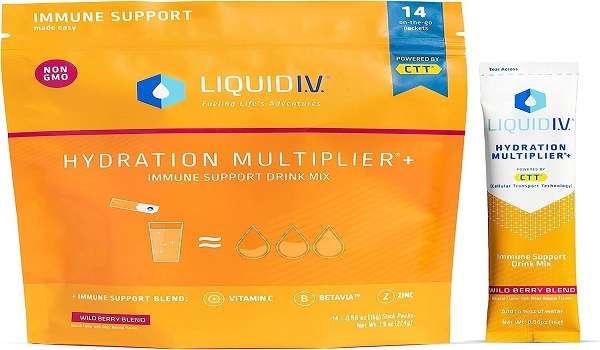

Liquid IV, the largest global brand in Unilever’s health and wellbeing business, will directly compete with established energy and sports drink brands such as Prime, Red Bull, and Gatorade. The launch aligns with HUL’s plan to increase the premium share of its portfolio by nine percentage points in the beauty and wellbeing segment, which currently generates the company’s highest profits.

“Our portfolio is largely composed of core or mass-market products that are highly penetrated. We aim to shift the portfolio toward premium by 900 basis points,” said Harman Dhillon, Executive Director of Beauty and Wellbeing at HUL. “We have identified under-penetrated formats that are witnessing rapid adoption, with consumers willing to pay more for premium offerings.”

Unilever acquired Liquid IV in 2020 and has since quadrupled its growth, making it the largest powdered hydration brand in the U.S. The product has also been launched in the UK, China, Canada, Australia, Mexico, and the Netherlands. In India, the hydration market is valued at approximately $1 billion annually, with demand primarily concentrated in urban areas.

HUL has identified a significant gap in the premium beauty and wellness segment, aiming to target nearly 70 million affluent and super-affluent households in India. “Wellbeing and hydration are critical factors influencing how people look and feel,” said Dhillon. “Liquid IV is designed for affluent consumers aged 18 to 45, who travel frequently, maintain active lifestyles, and prioritize their health.”

According to Euromonitor, the Indian nutraceuticals market is currently valued at ₹47,000 crore, with fortified and functional food products leading the segment, followed by dietary supplements. Mainstream fast-moving consumer goods (FMCG) companies, including HUL, are entering the market with a focus on functional food and wellness products.

HUL has already made significant investments in the health and wellness market. In 2023, the company invested in Zywie Ventures, which sells plant-based supplement brand Oziva, and Nutritionalab, which offers wellness-focused nutritional products. Last week, HUL further expanded its presence in the sector by acquiring direct-to-consumer beauty brand Minimalist for ₹2,955 crore.

“Beauty and wellbeing are deeply interconnected. Consumers, especially in the premium segment, understand that what they consume affects their skin and hair health, and hydration is becoming increasingly important,” Dhillon added.

In April last year, HUL reorganized its beauty and personal care division to enhance its focus on premium beauty and wellbeing. The segment now accounts for nearly a fifth of HUL’s total sales and contributes about a third of its overall profit.