Ice cream industry to touch Rs. 50,000 mark by 2028

Mumbai, May 24, 2024 — The Indian ice cream industry is on a fast track to significant growth, according to a new report by Firoz Haider Naqvi, Editor & Publisher of Ice Cream Times. The comprehensive report titled “Report on the Indian Ice Cream Industry: Growth Prospects and Potential” provides an in-depth analysis of the market, highlighting key growth drivers, market segmentation, and opportunities for allied sectors and foreign investments.

Market Expansion and Growth Projections

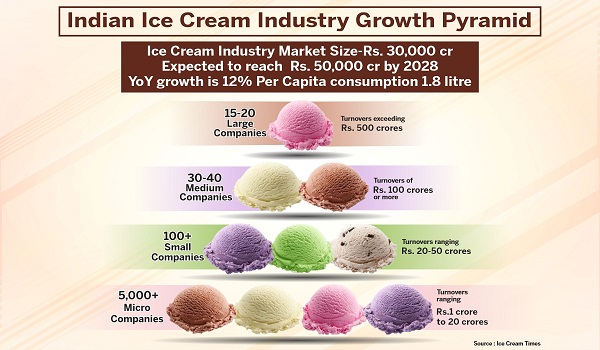

The Indian ice cream market, currently valued at approximately Rs. 30,000 crore (USD 2 billion) as of March 2023, is projected to grow at a compound annual growth rate (CAGR) of 10–12% over the next five years. This growth trajectory is expected to propel the market to an impressive Rs. 50,000 crore by 2028. With per capita consumption of ice cream in India crossing 1.8 litres, the potential for further growth is substantial.

Key Drivers of Growth

The report identifies several key factors driving this robust market expansion:

- Increasing Disposable Incomes: As incomes rise, consumers are more inclined to spend on premium and indulgent ice cream products, particularly in urban areas.

- Changing Consumer Preferences: There is a growing demand for novel flavours, health-conscious options, and premium products such as gelato and frozen yoghurt.

- Urbanization and Lifestyle Changes: Urbanization has spurred demand for ready-to-eat and convenience foods, including ice cream. Modern retail formats and online delivery services have also enhanced product accessibility.

- Expansion of Retail Networks: The proliferation of modern retail outlets and e-commerce platforms has significantly improved product availability and visibility.

Market Segmentation and Trends

The report segments the market by type, flavour, and distribution channel:

- By Type: Impulse ice cream (bars, cones) holds the largest market share due to its convenience and affordability. Take-home ice cream (tubs, boxes) and artisanal ice cream are also growing steadily, driven by consumer interest in unique and high-quality ingredients.

- By Flavour: While traditional flavours like vanilla, chocolate, and mango dominate, there is an increasing demand for exotic and fusion flavours.

- Distribution Channel: Includes supermarkets and hypermarkets, convenience stores, ice cream parlours, and online platforms. Online sales are particularly growing due to the convenience and variety offered.

Opportunities for Allied Sectors

The expanding ice cream industry presents numerous opportunities for allied sectors:

- Ice Cream Processing Machinery and Automation: There is a growing demand for advanced processing machinery and automation to enhance production efficiency and product quality.

- Packaging Machinery and Materials: Innovations in sustainable and functional packaging are increasingly in demand, driven by consumer preferences for eco-friendly and convenient solutions.

- Cold Chain Logistics and Freezers: Efficient cold chain logistics and reliable commercial freezers are crucial for maintaining product quality and safety.

- Ice Cream Ingredients: The demand for high-quality flavours, colours, emulsifiers, stabilizers, dry fruits, nuts, skimmed milk powder, fresh milk, and chocolate is rising as manufacturers aim to improve product quality and variety.

Opportunities for Foreign Companies and FDI

The report also highlights significant opportunities for foreign direct investment (FDI) and the entry of multinational brands into the Indian market. With favourable FDI policies and a growing consumer base, foreign companies can enter through joint ventures, greenfield investments, and mergers and acquisitions.

Top Regions and Brands

Maharashtra, Gujarat, Uttar Pradesh, Delhi, Punjab, Karnataka, and Telangana are identified as top regions with significant market share. Leading brands such as Amul, Hindustan Unilever (Kwality Wall’s), Mother Dairy, and Vadilal continue to dominate, while numerous small and medium enterprises contribute to the market’s regional diversity.

Conclusion The Indian ice cream industry is poised for substantial growth, driven by favourable demographics, rising incomes, and evolving consumer preferences. Companies that innovate and expand their