AC, refrigerator, and ice cream fly off shelves as summer heat strikes.

The demand for air conditioners, which are increasingly a must-have in middle-class houses, and air coolers has increased.

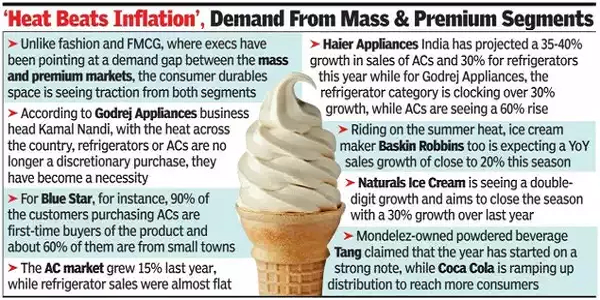

The scorching heat has boosted sales of consumer durables, with industry players expecting the strongest summer in recent years. Demand for air conditioners, which are now a must-have in middle-class houses, as well as air coolers, has increased, and refrigerator sales are healthy. “This looks to be one of the best summers for the industry,” said Kamal Nandi, Godrej Appliances’ business head and executive vice president.

Nilesh Gupta, Vijay Sales director, informed that this summer might be the greatest in the last 10-15 years, with the industry likely to increase by more than 30% over the previous year. According to industry sources, the air conditioning market increased by 15% last year, while refrigerator sales remained nearly constant.

Several ice cream and cold beverage companies estimate sales to rise 20-30%. Baskin Robbins, an ice cream company, expects a year-on-year sales increase of about 20% this season. The demand for the brand’s sundaes and dessert alternatives has skyrocketed, according to Mohit Khattar, CEO of Graviss Foods, which controls the American brand’s master franchise rights in India.

Naturals Ice Cream is seeing double-digit growth across all zones and expects to conclude the season with a 30% increase over previous year. Its soft coconut and mango ice creams are flying off the shelves. “E-commerce has grown significantly, and due to the heat wave, consumers are preferring home consumption during day time,” said Srinivas Kamath, the director of the company.

Coke appears to have rediscovered its fizz in Cola, as the company expands distribution to reach more customers. “In India, we are always attuned to market dynamics and consumer preferences,” said a Coca-Cola Company representative, who refused to comment on sales figures.

Mondelez-owned powdered beverage Tang stated that the year had begun on a high note. As it competes with a slew of other market competitors, the brand is attempting to establish customer engagement through presence at several contact points, according to Nitin Saini, VP (marketing) at Mondelez India.

In contrast to other categories, such as fashion and fast-moving consumer goods, where CEOs have pointed to a demand gap between the mainstream and premium markets, the durables industry is experiencing growth from both groups. “We’ve all said that there’s inflationary pressure on the mass markets, which means that consumption of discretionary items is under pressure. However, considering the heat we are seeing across the country, refrigerators and air conditioners are no longer considered optional. It’s become a need. “Heat is outperforming inflation,” stated Nandi.

In the consumer durables area, overall demand is driven by AC, but while the category is premium in nature, entry level goods are finding more room in customers’ shopping carts, with consumer finance playing an important role. For Blue Star, for example, 90% of clients purchasing air conditioners are first-time purchasers, with around 60% coming from small areas. “Within households, ACs can be installed in multiple rooms and therefore the growth potential of the category is huge,” B Thiagarajan, the company’s managing director, said.

Haier Appliances India expects a 35-40% increase in AC sales and a 30% increase in refrigerator sales this (whole) year, while Godrej Appliances expects refrigerator consumption to expand by more than 30% and AC consumption to climb by 60%.

“Brands are balancing both trends (premiumisation and mass market) by diversifying their portfolio,” said Alok Tickoo, executive vice-president of Llyod, a Havells brand.