Vietnam’s dairy industry is witnessing robust sales growth, fuelled by the expanding middle class and rising wealth. With the population’s increasing demand for milk and dairy products, opportunities abound for foreign investors eager to tap into this dynamic market. However, navigating the sector comes with its own set of challenges.

The country’s per capita milk consumption is anticipated to surge by approximately 40%, from 28 litres in 2021 to 40 litres per year by 2030, according to Research and Markets. Despite this growing demand, Vietnam’s domestic milk production falls short, leading to a significant reliance on imports to meet consumer needs.

The Vietnamese government is actively endorsing dairy as a crucial part of a balanced diet, evident in initiatives like the School Milk Program and the ‘Stand Tall Vietnam Milk Fund,’ operated by Vinamilk. These programs aim to ensure a steady supply of milk, particularly for children in kindergartens and elementary schools.

Beyond traditional liquid milk, there is a noticeable shift in consumer preferences, influenced by the growing popularity of Western cuisine. This has led to increased demand for cheese, butter, and yogurt, creating additional avenues for investors in the dairy sector.

Investment Opportunities in Vietnam’s Dairy Sector

Dairy Processing Companies: Investing in established dairy processing companies, such as the case of Growtheum Capital Partners committing $100 million to acquire a stake in the Vietnam International Dairy Joint Stock Company, provides investors with valuable market knowledge and a shortcut to market entry.

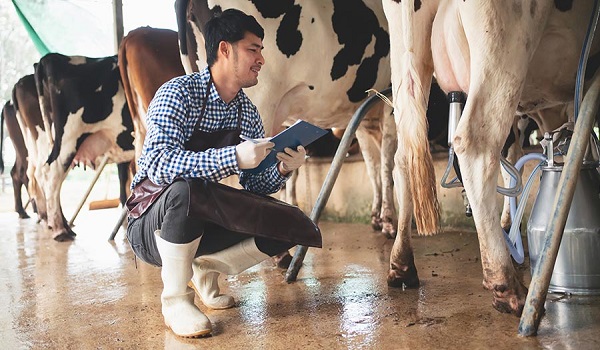

Dairy Farming: While investing in dairy farms is an option, it requires expertise in animal husbandry. Some domestic dairy companies in Vietnam are addressing this challenge by establishing farms abroad, such as VitaDairy’s $10 million farm with 1,000 cows in Tasmania, Australia, and Vinamilk’s dairy complex in Xieng Khouang, Laos.

Diversification into Various Dairy Products: Investors can explore opportunities in companies specializing in various dairy products beyond traditional milk. The success story of Bel Group’s Laughing Cow cheese brand, which invested $17 million to establish a factory in Vietnam, demonstrates the profitability of such ventures.

Technology and Equipment: Integration of technology, such as automated milking systems and feeding systems, presents opportunities for investors to enhance productivity and efficiency within the dairy industry.

Challenges and Considerations:

Market Competition: Domestic brands like Vinamilk dominate the market, holding a significant market share. New entrants or foreign investors must carefully strategize to effectively compete against these well-established local players.

Regulations: Free trade agreements, such as the European Union-Vietnam Free Trade Agreement and the CPTPP, can impact the dairy industry by reducing import tariffs on foreign products. While presenting challenges, these agreements also encourage domestic businesses to improve their production processes.

Climate Change Risks: Vietnam’s agricultural sector, including dairy farming, is vulnerable to climate change risks, impacting feed availability, animal health, and overall farm productivity.

Moving Forward:

While challenges exist, Vietnam’s dairy industry offers lucrative opportunities for investors. Beyond traditional milk products, there are avenues for investment in various sectors, including dairy products, farming, and technology. However, navigating this dynamic market requires a careful understanding of regulations, market competition, and climate-related risks. Firms seeking to enter Vietnam’s dairy market can benefit from expert guidance and market entry support from experienced professionals.