As temperatures soar across cities in India, both FMCG giants and local kiranas are scrambling to stock up on summer-centric goods. According to a recent survey conducted by India’s Kirana Community and Kirana Club, Maharashtra stands out as the only state where retailers report equal sales for both national and local cold drink brands. Kirana owners in Maharashtra note that local brands are performing on par with major national players like Pepsi, Coca-Cola, Thums Up, and Sprite.

The survey reveals that nationally, 68% of kiranas report higher sales for cold drinks from national FMCG brands compared to local ones. This trend is consistent across other states such as Uttar Pradesh, Madhya Pradesh, Bihar, Rajasthan, and Chhattisgarh, where a majority of retailers (ranging from 60% to 75%) indicate a preference for national brands.

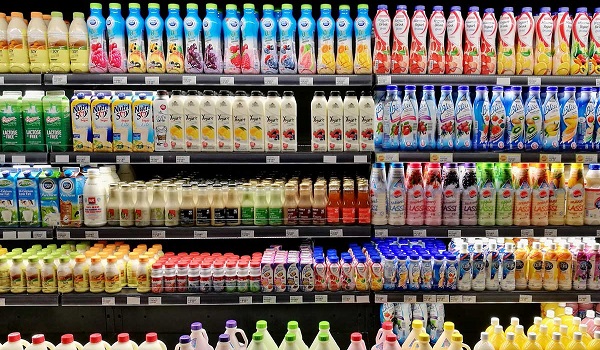

In terms of popularity among children during the summer season, Frooti emerges as the top choice, with 24% of retailers reporting higher sales for this brand. Following closely are Maaza (19%), Sprite (8%), Dew and Sting (6% each), Coke (5%), Pepsi and Thums Up (3% each), while Appy Fizz and Jeera Soda each capture 2% of the market. Other notable brands include 7UP, Appy Fizz, Fanta, Paper Boat, Slice, Limca, Amul Kool, Priya Lassi, and Fundaaz.

Kiranas are also diversifying their summer offerings, stocking dairy products like ice cream and curd (16%), talcum powder (7%), as well as glucose and Rasna (6%).

The report also highlights an emerging trend in energy drinks, particularly popular in states like Uttar Pradesh, Bihar, Maharashtra, and Jharkhand.

Anshul Gupta, founder of Kirana Club, comments on evolving consumer preferences, noting a growing acceptance of local cold drink brands, especially in Maharashtra. He emphasizes the importance of understanding hyperlocal consumer preferences and foresees increased potential for regional brands across India in the coming years.

With the summer months traditionally witnessing significant growth in the beverage industry, the survey underscores the importance for retailers to adapt to changing consumer tastes and preferences.